Interpretation caveat

As the Labour Codes have only recently come into force, further rules and clarifications may follow. The inputs below reflect the current understanding and may evolve over time.

With the Labour Codes becoming effective from 21.11.2025, there are clear actuarial and accounting implications for Bhartiya Group’s gratuity valuation. The overall impact will mainly depend on:

-

Proportion of fixed-term employees, and

-

Proportion of allowances vs basic/DA in your CTC structure (which may need review under the Code on Wages, 2019).

1) Earlier gratuity eligibility for fixed-term/contract employees

Under Section 53 of the Code on Social Security, 2020, gratuity normally requires 5 years of continuous service.

However, the proviso for Fixed-Term Employment (FTE) creates an exception:

-

On completion of a fixed-term contract, gratuity becomes payable on a pro-rata basis, even if 5 years are not completed.

-

Recent press clarifications indicate that FTEs may effectively become eligible from 1 year of service.

Valuation impact

-

Wider eligible population: All fixed-term employees now need to be included in the gratuity census.

-

Earlier accrual: Benefits start from Year 1 → higher Current Service Cost (CSC).

-

Higher DBO: A group previously assumed to have “nil” liability will now accrue gratuity.

-

Separate decrement modelling: Contract expiry/renewal patterns differ from typical resignations; FTE withdrawals must be modelled separately.

Net effect: For organisations with significant fixed-term staffing, both gratuity liability and annual expense will rise from FY25-26.

2) Unified wage definition & the 50% rule increase the gratuity base

The Code on Wages, 2019 introduces a standard definition of “wages” and the 50% cap:

-

If excluded allowances exceed 50% of total pay, the excess must be added back into “wages.”

-

Since gratuity is based on wages last drawn, the effective salary used for valuation increases.

Valuation impact

-

Higher benefit salary for allowance-heavy structures.

-

Increase in DBO and CSC wherever basic/DA is below 50%.

-

Possible one-time actuarial gain/loss if pay structures are rebalanced mid-year.

Net effect: Even without FTE exposure, gratuity costs increase where CTCs rely on low basic and high allowances.

3) Expected overall impact (from FY25-26)

-

Higher gratuity provision (DBO) at year-end

-

Higher annual gratuity expense (CSC)

-

Shift in cash flows, as FTE exits trigger earlier payouts

Key drivers remain:

-

Share of fixed-term employees

-

Allowance-to-basic ratio in the salary structure

4) Recommended next steps (we can support end-to-end)

1. Census refresh

-

Classify permanent vs fixed-term employees clearly

-

Capture contract end dates and renewal expectations

2. Wage structure diagnostic

-

Identify cohorts where allowances exceed 50% of remuneration

3. Re-run gratuity valuation under the new regime

-

Scenario A: Current wage structure + inclusion of FTE

-

Scenario B: Rebalanced wage structure + inclusion of FTE

→ This will quantify the incremental DBO and FY25-26 expense impact.

4. Accounting alignment

-

Update Ind AS 19 / AS 15 disclosures to reflect revised eligibility rules and wage definition from 21.11.2025.

Mastering Complexity:

Transforming Challenges into Strategic Opportunities

Managing employee benefit liabilities presents a complex set of challenges that businesses must proactively address to ensure financial stability, compliance, and workforce satisfaction. Key challenges include accurate valuation of gratuity and leave encashment, aligning employee stock options (ESOPs) and long service awards (LSAs) with corporate performance, mitigating funding and tax planning risks, adapting to regulatory changes, and balancing short-term cash flow with long-term liabilities. At JACS, we provide expert actuarial insights to help organizations overcome these challenges, ensuring strategic financial planning, operational efficiency, and sustained employee trust.

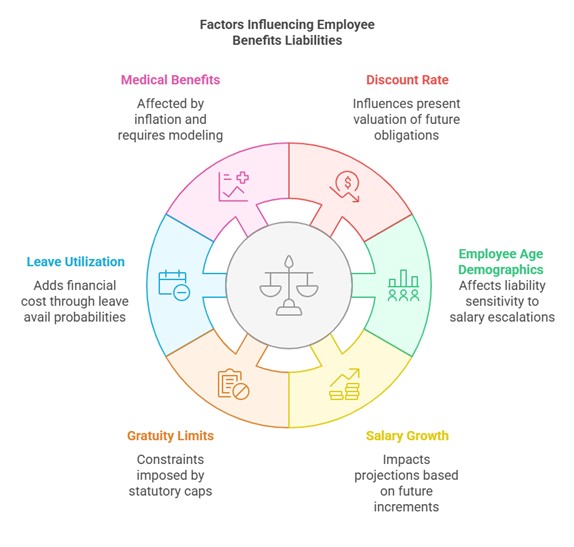

Key Factors Affecting Gratuity Liabilities

- Discount Rate: 📉 The discount rate is based on the weighted average duration of the liability and aligned with yields from risk-free bonds, and this significantly influences the present valuation of future gratuity obligations.

- Employee Age Demographics: 👨💼👩💼 Employees closer to retirement accrue higher gratuity liabilities due to their extended tenure, whereas younger employees experience liabilities that are more sensitive to projected salary escalations relative to the discount rate.

- Salary Growth and Escalation Rate: 📈 Future salary increments have a significant impact on liability projections. Sensitivity analyses in actuarial reports help evaluate the potential effects of salary fluctuations.

- Gratuity Limits: 🛑 Statutory caps on gratuity accumulation, as defined by labour laws, impose constraints on liability estimates.

- Leave Utilization Metrics: 📊 The valuation of compensated leaves considers the probability of leave utilization, adding an implicit financial cost to employers.

- Post-Retirement Medical Benefits: 🏥 Medical cost inflation significantly impacts post-retirement healthcare liabilities, requiring detailed actuarial modeling to assess financial feasibility.

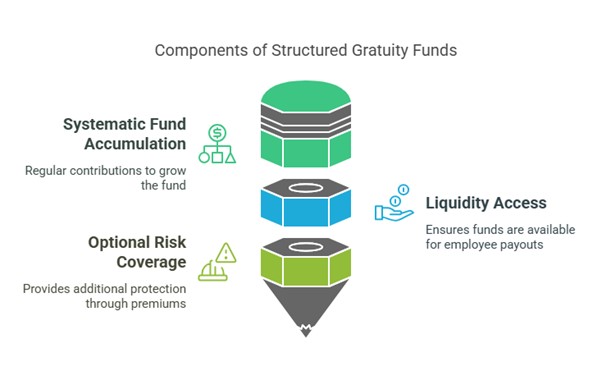

Strategic Approaches to Gratuity Funding

Although there is no legal requirement to pre-fund gratuity liabilities, proactive funding is a best practice that enhances financial stability and reduces balance sheet volatility. A structured funding approach helps organizations optimize financial planning.

Insurance providers such as LIC offer structured gratuity funds with the following benefits:

- 💰 Systematic fund accumulation through periodic contributions.

- 🔑 Access to liquidity for meeting mandatory employee payouts.

- 🛡️ Optional risk coverage via supplemental premium contributions.

These structured funds function similarly to mutual funds and savings instruments, ensuring efficient liability management and predictable financial outcomes.

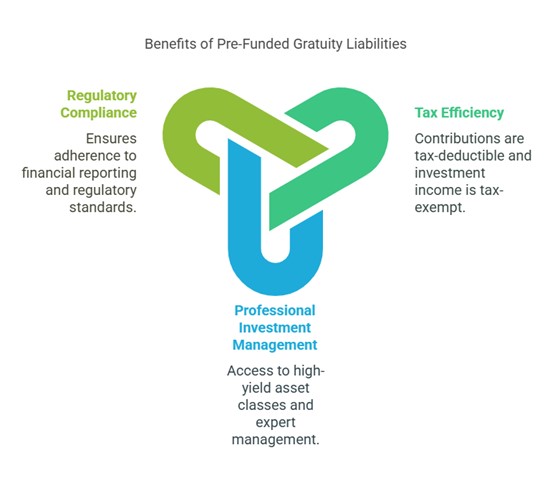

Advantages of Pre-Funded Gratuity Liabilities

- Tax Efficiency: 💸 Contributions up to 8.33% of an employee’s base salary (or historical service salary for newly established funds) are tax-deductible. Additionally, investment income generated within the fund is tax-exempt.

- Professional Investment Management: 🏦 Collaborating with insurance providers offers access to high-yield asset classes, diversified investment portfolios, and expert financial management.

- Regulatory Compliance: 📜 Annual actuarial certifications are necessary to comply with financial reporting standards and regulatory requirements.

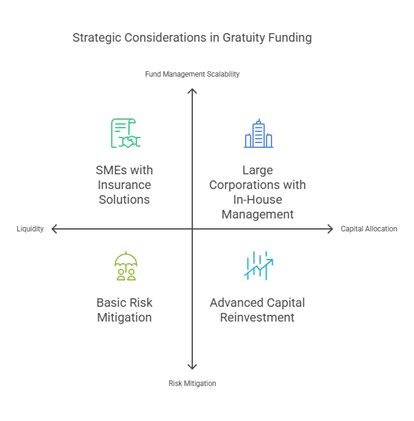

Considerations for Gratuity Funding Strategies

Certain jurisdictions, such as Karnataka, enforce minimum funding mandates, and many corporations establish internal funding reserves according to their risk appetite. When designing a comprehensive gratuity funding strategy, organizations should assess:

- Liquidity vs. Capital Allocation: ⚖️ Balancing the need for liquid reserves for payouts against reinvesting capital into business expansion.

- Risk Mitigation Strategies: 📊 Implementing actuarial methodologies to reduce balance sheet exposure to liability fluctuations.

- Fund Management Scalability: 📈 Large corporations may prefer in-house fund management, whereas SMEs often benefit from insurance-backed funding solutions.

Organizations can select between traditional guaranteed-return instruments and market-linked gratuity plans, depending on their risk appetite and investment strategy.

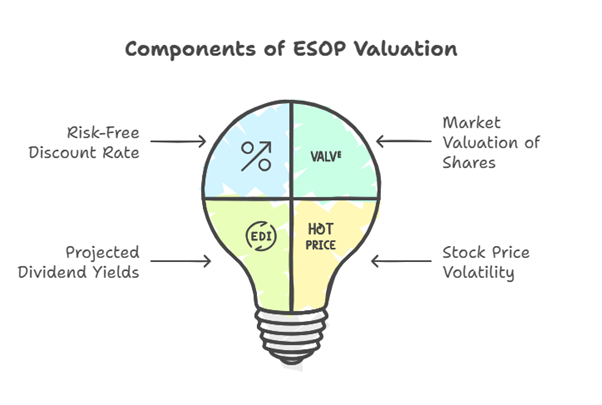

Employee Stock Option-ESOP – Valuation Technique

Employee Stock Options (ESOPs) are a key component of executive compensation packages, aligning employee incentives with corporate performance. The Black-Scholes option pricing model is commonly used for ESOP valuation, incorporating:

-

- Risk-Free Discount Rate: 📉 Based on prevailing government bond yields.

- Market Valuation of Shares: 💹 Establishing an intrinsic valuation benchmark.

- Projected Dividend Yields: 💵 Factoring in expected returns on equity.

- Stock Price Volatility: 📈 Accounting for variability in market pricing trends.

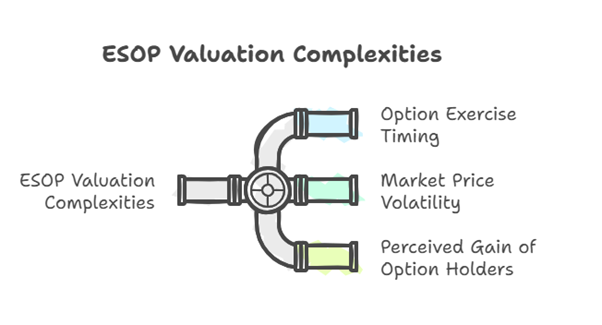

Challenges in ESOP Valuation

ESOP valuation complexities arise due to:

- Option Exercise Timing: ⏳ Employees may exercise stock options at varying points, impacting valuation.

- Market Price Volatility: 📊 Fluctuating stock prices affect option value upon exercise.

- Perceived Gain of Option Holders: 💰 The gap between the exercise price and market valuation determines the real financial benefit for employees.

Actuarial analysis refines valuation assumptions, ensuring regulatory compliance and optimizing ESOP structuring to reduce costs and mitigate risks.

Long Service Award Valuation and Strategic Implementation

Understanding Long Service Awards (LSAs)

Long Service Awards (LSAs) recognize employee loyalty and tenure, typically granted after completing ten or more years of continuous service. These awards, often in the form of monetary bonuses or certificates, enhance employee retention and engagement.

- Impact on Retention: 📊 Analyzing LSAs’ influence on reducing employee turnover.

- Employer Branding: 🌟 Strengthening corporate reputation through structured recognition programs.

- Equity in Recognition: ⚖️ Ensuring fairness and consistency in award distribution.

- Workforce Productivity: 🚀 Assessing the motivational impact of LSAs on employee performance.

Through advanced actuarial modeling, we help organizations structure LSAs that are financially sustainable and aligned with employee engagement goals.